agapay

Agapay

Agapay is an open network for charitable payments.

Agapayis a play on the wordagapewhich means “love” in Greek. It is a form of love that is selfless and unconditional.

Overview

The Problem

There are ~1.5M nonprofits in the US today that don’t have an easy or open method to accept payments securely and reliably via any

open-networkelectronic payment method.

The IRS maintains a list of most tax-exempt organizations’ physical addresses. This database doesn’t include many religious organizations, addresses are notoriously inaccurate, and the best you can do is to mail a paper check and hope for the best.

PayPal Giving Fund and PayPal Grant Payments offer convenience for charitable payments for a significant cost and vendor lock to payers and with little regard for the nonprofit experience.

Grantmakers aim to distribute funds to nonprofits in a secure, electronic, and cost-efficient manner.

However, current practices require each grantmaker to independently establish and manage a system for registering electronic payment information, presenting both technical and operational challenges.

Today, these systems are a huge cost-center and resource drain for grantmakers to maintain compliance and up-to-date information on all nonprofits within their systems.

Grantmakers must revert to issuing checks when nonprofits are not present in their system. Compounding the issue is the fact that every grantmaker is redundantly undertaking the same laborious technical and operational tasks.

From the perspective of nonprofits, they are required to register with over 50 grantmaker portals to receive electronic payments. This process involves managing numerous portals and logins, making the task of reconciling payments with their respective data exceedingly cumbersome.

A New Approach

What if you could?

- pay any nonprofit organization

- instantly

- via your preferred payment rail

- without needing to maintain a database

- have fraud, compliance, and verification checks out of the box

- and attach data or documents to the payment

In a sense, that’s exactly what Agapay does.

Concepts

Agapay is a network for charitable payments.

Entity

An Entity represents a tax-exempt (as defined by the IRS) nonprofit or a fiscal sponsor for a charitable organization.

An entity is a legal entity with a name, EIN (Federal Tax ID), officers, and a physical address.

There are approximately 1.5M nonprofits in the US.

Organization

An Organization represents an operating entity or an operating sub-organization of a parent or sponsoring entity.

Organizations can receive payments from payers on the network.

Organizations are associated with a web domain, logo, and a set of verified addresses where they can receive payments.

Address

A Address is a public-facing identifier that can be used to send payments to an Organization.

An Organization is said to be “addressable” if it has at least one Address.

An Address can take many forms depending on the type of payment rail used:

Postal Address

A postal address is a mailing address where physical mail can be received. Postal addresses are used to send paper checks.

US Bank Account

A US bank account is a financial account that can be used to securely receive electronic payments. A bank account address is usually composed of an account number and a routing number. The routing number is the American Bankers’ Association (ABA) Routing Transit Number (RTN). The account number is an identifier specific to the receiving bank that uniquely identifies an account that can receive payments. Bank account addresses (account and routing numbers) can be used to send ACH, RTP, wire transfers, and FedNow payments.

Service Provider

A Service Provider is a 3rd-party organization that issues verifiable Addresses to nonprofit Organizations.

Chariot is the first Service Provider to offer Addresses to nonprofits.

This doesn’t necessarily mean Chariot will be the only Service Provider in the network.

Verifiable Credential

A Verifiable Credential or VC is a digital credential that is issued to an Organization by a Service Provider.

The VC proves authenticity and validity of an Entity, Organization, or Address and allows anyone to instantaneously verify the information presented.

For more information about VCs, see the W3C Verifiable Credential specification.

How it works

For the Recipients

To join the network, an Organization works with a Service Provider (e.g. Chariot).

In order to onboard, the Service Provider needs to trust the nonprofit Entity and Organization.

The Service Provider will perform KYB/KYC checks on the Entity and Organization and issue them

public-facing Addresses along with Verifiable Credentials attesting to the authenticity of the Entity, Organization, and Address.

In Chariot’s case, organizations are issued a Chariot bank account

with public-facing, non-sensitive routing and account numbers.

This non-sensitive account and routing number is a valid US Bank Account Address.

If a nonprofit entity acts as a fiscal sponsor for subsidiary organizations,

the Agapay network allows each subsidiary to exist as a separate Organization with their own Address.

Note that in this case, the parent entity is responsible for the financial obligations of the subsidiary entities

and therefore issuance of an Address is conditional upon the parent entity’s approval (part of the KYB/KYC process).

Additionally, the Agapay network allows for a single Organization to have multiple Addresses

if they want to share certain addresses with specific groups of payers or for other reasons

like accounting purposes or fund designations.

Organizations can indicate their preferred Address to other payers in the network.

For the Payers

Payers are the individuals or organizations that send payments to Organizations in the Agapay network.

While we envision a world where anyone could be a payer and use the network for free, we also recognize that would come with its own set of challenges.

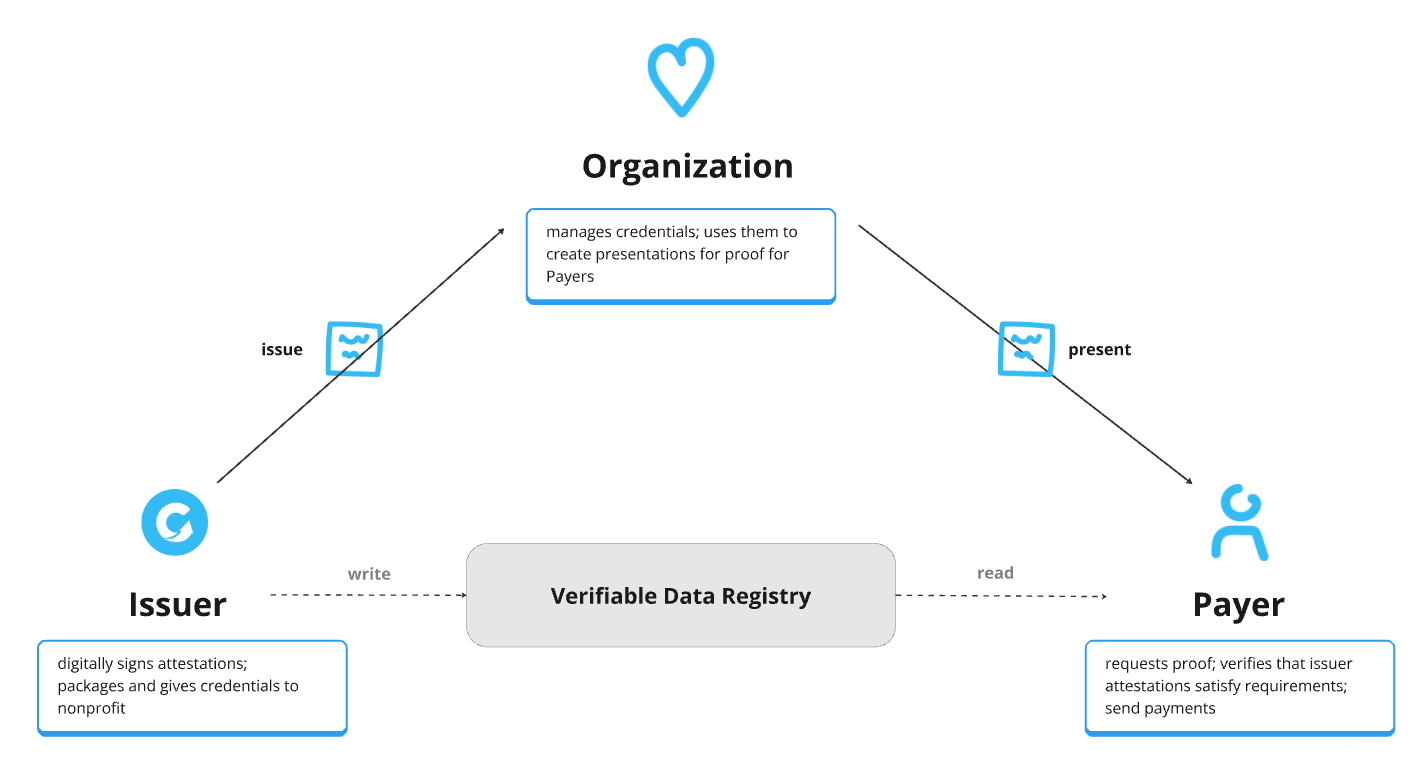

Ultimately, an open network built upon Verifiable Credentials still operates in a “triangle of trust” between issuer (Chariot), holder (Nonprofit Organization), and verifier (Payer).

Note that because Verifiable Credentials can be created by anyone, the verifier (Payer) needs to decide if they trust the issuer.

For now, it’s easier if the verifier has a direct relationship with the issuer (Chariot).

To join the network, a prospective payer registers for an account with Chariot and goes through an onboarding process.

After they are approved and verified, they are given API keys.

If we wanted to support end-to-end payment solutions, we would also set up a payment account (FBO) for the payer.

The payer then has 3 options to send payments to Organizations:

- Read the Organization’s Address via API and send a payment via their preferred payment method

In this flow, the payers call the API to read the public-facing

Addressidentifier and create a payment intent for a payment that will be sent via the appropriate payment rail. This option is ideal for payers that manage their own Accounts Payable systems or already have capabilities to send payments. - Delegate

ChariotAPI access to Accounts Payable systems In this flow, the payers delegateChariotAPI access to their Accounts Payable systems via an OAuth application. The Accounts Payable systems can then read the Organization’sAddressvia API and send a payment via the appropriate payment network. Note that this method requires Chariot to offer OAuth and for charitable AP systems to have built an integration with theChariotAPI. - Use Chariot’s hosted payment solution

In this flow, the payers use Chariot’s hosted payment solution to send payments to the

Organizations. This option is ideal for payers that do not want to manage their own Accounts Payable systems and/or want to offload the responsibility of sending payments altogether. In the future,Chariotcould also offer our own Accounts Payable system that is integrated with theChariotAPI.

API Reference

Authorization

The API accepts Bearer Authentication. When you sign up for a Chariot account, we make you a pair of API keys: one for production and one for our sandbox environment in which no real money moves. You can create and revoke API keys from the dashboard and should securely store them using a secret management system.

OpenAPI

The Chariot API is documented using OpenAPI.

This spec is in beta and subject to change. If you find it useful, or have feedback, let us know!

Errors

The API uses standard HTTP response codes to indicate the success or failure of requests. Codes in the 2xx range indicate success; codes in the 4xx and 5xx range indicate errors. Error objects conform to RFC 7807 and can be distinguished by their type attribute. Errors will always have the same shape.

{

"status": 400,

"type": "Bad Request",

"title": "failed to create bank account",

"detail": "your request contains invalid parameters: the name must be at least 3 characters long",

}

Idempotency

The API supports idempotency for safely retrying requests without accidentally performing the same operation twice. This is useful when an API call is disrupted in transit and you do not receive a response. For example, if a request to create a payment does not respond due to a network connection error, you can retry the request with the same idempotency key to guarantee that no more than one payment is created.

To perform an idempotent request, provide an additional, unique Idempotency-Key request header per intended request.

We recommend using a V4 UUID. Reusing the key in subsequent requests will return the same response code and body as

the original request along with an additional HTTP header (Idempotent-Replayed: true).

This applies to both success and error responses.

In situations where your request results in a validation error,

you’ll need to update your request and retry with a new idempotency key.

Idempotency keys will persist in the API for at least 1 hour.

If an original request is still being processed when an idempotency key is reused, the API will return a

409 Conflict error.

Subsequent requests must be identical to the original request or the API will return a

422 Unprocessable Entity error.

We discourage setting an idempotency key on GET and DELETE requests as these requests are inherently idempotent.

Future Roadmap & Strategy

The vision for this project is to create a truly open database and network for payments to nonprofits.

As part of this vision, we need to differentiate it from existing payment networks and databases, e.g. PayPal.

What’s needed?

Digital Credentials

The Verifiable Credentials model places the holder (Nonprofit Organization) at the center of the identity system

and giving them control over their identity and data.

The trust model is more “decentralized” and allows for a more open and competitive marketplace of identity solutions.

Service Providers can issue Verifiable Credentials to Entities, Organizations and Addresses.

Verifiable Credentials make the information in the database instantly verifiable and tamper-resistent.

Database

At the crux of an open network is the database of Organizations and their Addresses.

We believe this database should be completely public and free.

Organizations should retain self-sovereignty over the data in the database.

The database itself enforces consistency and validity through a distributed consensus model.

There exists a contract between the network Service Providers and the database that ensures data records are valid Addresses.

Settlement Layer

The actual settlement layer is decoupled from the database of Addresses.

Addresses are simply pointers to real-world identifiers in a payment network’s settlement layer.

This allows the Agapay network to service a variety of different settlement layers including

over the Federal Reserve’s RTP network, ACH, and card networks as well as utilizing

decentralized, blockchain-based networks like on-chain wallets, stablecoins and cryptocurrencies in the future.

Differentiation

- Open Network - Any

Organizationcan join and receive payments. - Open Database - The database is public and free.

- Self Sovereignty -

Organizationsown their ownAddressesand can move freely between network service providers or even be their own network service provider. - Network Agnostic -

Addressescan be used with anyopen-networkpayment network which encourages competition and drives down network costs for the benefit of participants. - Competition - Network

Service Providerscan compete on price and features which will drive down costs and increase innovation which has positive reinforcement feedback for the network itself.